The Strategic Role of Venture Debt in Startup Financing

Unwinding the labyrinth of startup funding options, with the magnifying glass on venture debt

Hello and welcome to The GTM Newsletter - read by over 50,000 revenue professionals weekly to scale their companies and careers. GTMnow is the media brand of GTMfund - sharing advice on go-to-market from working with hundreds of portfolio companies and the insight of over 350 of the best in the game executive operators behind the fund. They have been there, done that at the world’s fastest growing SaaS companies.

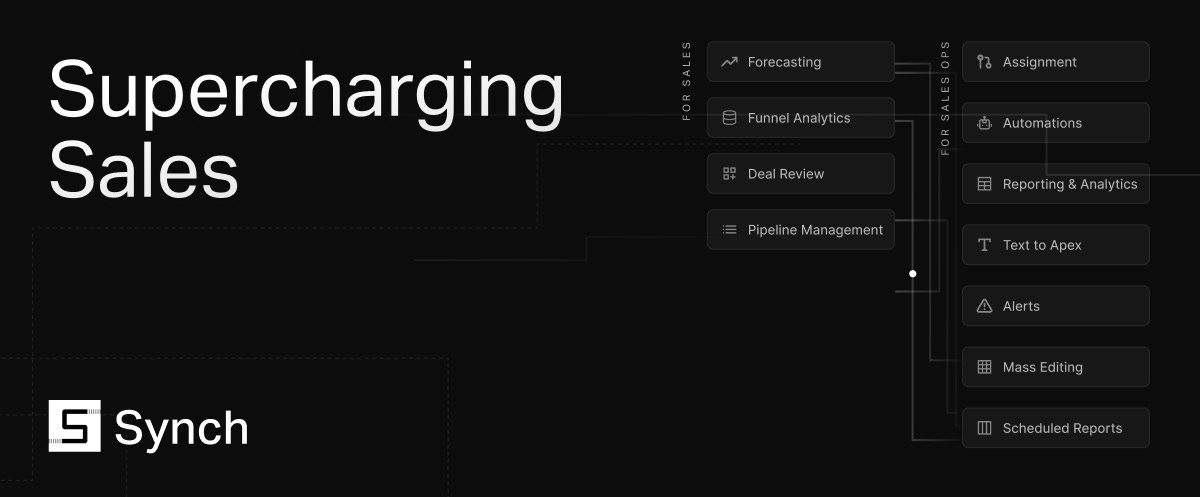

This week’s newsletter is brought to you by Synch — the only unified sales stack.

If you’re spending too much time managing your sales process and not enough time meeting your sales quota, Synch is here to help. Synch unifies your company’s revenue tooling so you can spend more time selling.

Synch offers forecasting, deal review, pipeline management, alerts, lead assignment, and other features connected via a shared analytics suite.

All of these features work out of the box with your Salesforce environment. No consultants. No add-ons or point solutions needed. Just Salesforce SSO & Go.

Covered today:

The strategic role of venture debt in startup financing.

More on GTM for your eardrums.

More on GTM for your eyeballs.

Startups to watch.

Hottest GTM jobs of the week.

GTM industry events.

The Strategic Role of Venture Debt in Startup Financing

We hear it time and time again that funding options can feel like a labyrinth to founders. While we provide venture equity, one of the complementary options we advise when it makes sense for a founder is venture debt.

From our perspective, it is complimentary to equity financing. Incorporating venture debt into a startup’s financing strategy is not about choosing one form of capital over another. It’s about leveraging the strengths of both to build a resilient and successful business. As VCs, our role is to provide the best possible support to our portfolio companies and founders.

This content was created with Nick Dolik, Managing Director at TriplePoint Capital.

Understanding venture debt

Venture debt is a form of debt financing provided to early-stage, high-growth companies. Unlike traditional loans, venture debt is typically offered by specialized lenders who understand the unique needs and risks associated with startups. This form of financing is often used in conjunction with equity financing to extend the runway, support growth initiatives, and manage cash flow.

From our perspective as venture capitalists, venture debt is not a competing tool but a complementary one. It allows startups to access additional capital without significant dilution of equity. This preservation of ownership is crucial for founders who wish to maintain control and for us as investors who aim to see the value of our equity stakes grow.

The hybrid approach

Combining equity and debt financing is known as the hybrid approach. This strategy leverages the benefits of both forms of capital, creating a more flexible and resilient financial structure for startups.

For example, TriplePoint Capital has pioneered the hybrid approach over the past two decades. They are primarily known as a debt financing partner to startups but also make equity investments when it makes strategic sense. This model allows them to support companies from seed stage through IPO, demonstrating the long-term value of combining these two forms of financing.

The benefits of venture debt

Venture debt offers several advantages that make it an attractive option for startups, and these benefits also align with our interests as venture capitalists.

Minimizing dilution: One of the primary benefits of venture debt is minimizing dilution. By using debt instead of equity, founders can retain a larger ownership stake in their company. This is particularly important for maintaining control and ensuring that the founders are motivated to drive the company’s success. For us, it means that the value of our equity investment is less diluted, which can lead to higher returns in the long run.

Extending runway: With venture debt, startups can secure additional capital to cover operational expenses and growth initiatives, giving them more time to achieve key milestones before raising another equity round. This extended runway can be crucial for improving valuation and attracting better investment terms in future funding rounds.

Strategic flexibility: Venture debt offers strategic flexibility that equity alone cannot provide. Startups can use it for acquisition financing, growth capital, or even as an insurance policy to extend their runway. This flexibility allows startups to seize opportunities and navigate challenges without immediately resorting to dilutive equity financing.

The current financing environment

The current state of the venture debt market reflects broader economic trends and startup financing dynamics. The early-stage market remains robust. However, the growth stage and late-stage markets have experienced some turbulence due to valuation resets and economic uncertainties.

Despite these challenges, the venture debt market offers a stable and complementary financing option. There’s a lot of capital available, and more founders are recognizing the benefits of venture debt. As VCs, staying informed about these market conditions helps us guide our portfolio companies to make strategic financing decisions that align with their long-term goals.

Practical advice for founders

For founders considering venture debt, it’s essential to approach it strategically. Here are some key pieces of advice from our perspective:

Understand your needs: Founders should have a clear understanding of their financial needs and growth trajectory. Knowing why you need the capital and how you plan to use it is crucial. As VCs, we appreciate founders who have a strategic plan and can articulate the role of venture debt in their overall financing strategy.

Build relationships early: Meeting potential lenders early and establishing trust can be invaluable. Building relationships before you need to raise capital helps ensure that when the time comes, you have a network of supportive partners who understand your business.

Choose the right partners: Selecting the right venture debt partners is critical. Look for lenders who understand your industry and have a track record of supporting startups. It’s not just about the money; it’s about finding partners who can add value beyond the capital.

🗓️ Upcoming digital live events

Crossbeam and Reveal are joining forces: the merger and what it means for go-to-market and ELG - July 17th at 8am PST / 11am EST

The Ultimate Cold Calling Playbook For Sales Leaders and Teams - July 24th at 10am PST / 1pm EST

👂 More for your eardrums:

The GTM Podcast - subscribe on Apple, Spotify, YouTube or wherever you listen.

David Greenberger leads CHEQ’s North America sales team. CHEQ is a cybersecurity platform primarily focused on protecting the Go-to-Market organization (preventing fake leads to sales team, skewed analytics from bots/malicious users etc). David is well-versed in building and perfecting Go-To-Market processes both from $0 and at 100 y/o companies. CHEQ is David’s 5th startup. Directly before CHEQ, David was in a leadership capacity at Hitachi Vantara, in the deep-enterprise Big Data / AI space. Prior to that he’s built teams at Foursquare, Yext, Angi and Splash.

👀 More for your eyeballs

Why GitHub has a 6 month comp plan for sales reps. Do reps like this? What’s the outcome and benefit?

A piece on growth or profitability, unpacking burn rates, data on what's “normal” / how burn impacts valuations.

🚀 Startup to watch

Armada - just announced a $40M funding round. This investment propels their total funding to over $100M and marks a significant milestone in their journey to bring AI to the edge and bridge the digital divide.

Writer - dropped a mind-blowing AI update: RAG on steroids, 10M word capacity, and AI ‘thought process’ revealed. This broad rollout marks a significant leap forward in making sophisticated AI technology more accessible and effective for businesses of all sizes.

🔥 Hottest GTM jobs of the week

Lead Growth Manager (F/M/X) at Crossbeam (Paris, France)

Business Development Team Lead at Stotles (London, UK | Hybrid)

Customer Support Advocate at Owner (Bogotá, Colombia - Remote)

Account Executive at Hone (Remote - US)

Account Manager, Convert at Gorgias (Toronto)

See more top GTM jobs on the GTMfund Job Board.

🗓️ GTM industry events

Upcoming go-to-market events you won’t want to miss:

Catalyst 2024: August 14 -16 (Chicago, IL)

SaaStr Annual: September 9 - 12 (Bay Area, CA)

INBOUND: September 18 - 20 (Boston, MA)

GTMfund Annual Retreat [community]: October 4 - 6 (San Diego, CA)

GTM Summit: October 14 - 16 (Austin, TX)

If you share on social, make sure to tag GTMnow so we can see your takeaways and help amplify them.

Taking some time off this upcoming week but between my daily scheduled work blocks and support from the team, I’ll still be in your inbox next Friday.

Have a great weekend ahead!

Barker ✌️