The State of GTM Jobs: Customer Success

Data report on CS role trends in collaboration with Live Data Technologies and 15 operators

Hello and welcome to The GTM Newsletter by GTMnow - read by 50,000+ to scale their companies and careers. GTMnow shares insight around the go-to-market strategies responsible for explosive company growth. GTMnow highlights the strategies, along with the stories from the top 1% of GTM executives, VCs, and founders behind these strategies and companies.

The State of GTM Jobs: Customer Success

At the crossroads of retention and revenue, Customer Success (CS) is a cornerstone for sustainable growth and is growing in both scope and importance.

This can be seen from hiring trends and also industry prominence. For example, a Chief Customer Officer Summit was hosted for the first time at SaaStr Annual this year.

This is the second part of our State of GTM Jobs series (read Part 1 about Sales on GTMnow or Substack). Special thanks to Jason Saltzman and Live Data Technologies for sharing access to real-time job change data for over 88 million professionals, revealing critical trends across customer success and go-to-market teams.

Another very special thank you to contributors for directly sharing insight and perspectives for this publication: John Gleeson (Founder & GP of Success Venture Partners / Co-Founder of Customer Success Meetup), Abbas Haider Ali (VP Customer Success at GitHub), Amy Oilman (SVP of Customer Success at Conversica), Andy Mowat (VP of Revenue Operations at Carta), Eliot Offutt (VP Customer Onboarding at Forma.ai), Elena Hutchison (Founder of Up/Right Analyst Relations), Mark Kosoglow (Co-founder and CEO at Operator), Scott Gifis (CEO at NoFraud), Neil Weitzman (Founder & Fractional CRO / GTM Operator at revenue•x), Richard Harris (Founder of The Harris Consulting Group), Rita Jhaveri (CEO at CX Growth Advisors), Justin Strackany (Sr. Director of Customer Success at Decisions), Marko Buric (Head of Cloud Customer Experience, Bay Area Enterprise at Google), Joanna Johnston (SVP Customer Success at Gong), and Erin Guagenti (VP of Customer Success at Productiv).

Let’s get into it.

Customer Success is on the rise

Let’s start with a simple, but crucial insight: Customer Success is growing, and the demand for these roles is becoming increasingly evident. As shown by hiring trends, CS roles are steadily on the rise, with a clear shift towards prioritizing retention and expansion over new customer acquisition.

This chart examines net arrivals and departure trends in customer success (CS) roles. The green bar represents net job arrivals, while the red bars represent net job departures. The purple line indicates the growth rate of retention and renewal roles as a percentage compared to January 1, 2022. A steady upward trajectory in the purple line signals consistent growth in the demand for these roles over time, with peaks and plateaus showing periods of acceleration or stabilization in hiring trends.

Customer success roles are rising in volume. By late 2023 and into 2024, the earlier volatility stabilizes more than previous years. Despite fluctuations, the data shows steady growth in the importance and demand for CS roles. CS roles have grown as a priority, which can be equated to many factors, one of which being economic pressures pushing companies to focus on customer retention over new customer acquisition.

It’s a balanced, selective growth trajectory. Unlike the rapid expansion in Sales or Product, Customer Success hiring is stable and strategic, rooted in the need to drive retention and expansion revenue.

Trends in seniority for CS hiring

This chart examines hiring trends across different levels of customer success (CS) roles, as indicated by the colors and labels.

Companies are increasingly adding across all levels. The ratio of executive roles has decreased in comparison to more individual-contributor roles, though both are growing.

A consideration around this data is that it is influenced by companies that are no longer growing at venture-backable scale.

“Many startups have fallen out of the “triple-triple, double-double” growth model that most go-to-market playbooks assumed for the past several years, which includes the baseline on which many Customer Success teams were structured. The reality now is that many companies no longer fit the venture-backed growth model and need to prioritize profitability. The primary ways to achieve this are by monetizing the post-sales motion or more closely aligning it with revenue.”

“There is also a separate category of companies experiencing true exponential growth—AI companies, for example, which continue to raise at extremely high valuations, sometimes even before achieving product-market fit. For these companies, the traditional approach to Customer Success is still highly valuable: allocating extra resources to ensure customers find value in the product, delivering exceptional experiences, and building strong loyalty as they work toward product stickiness and repeatable, value-driven outcomes across their customer base.”

-John Gleeson (Founder & GP of Success Venture Partners / Co-Founder of Customer Success Meetup)

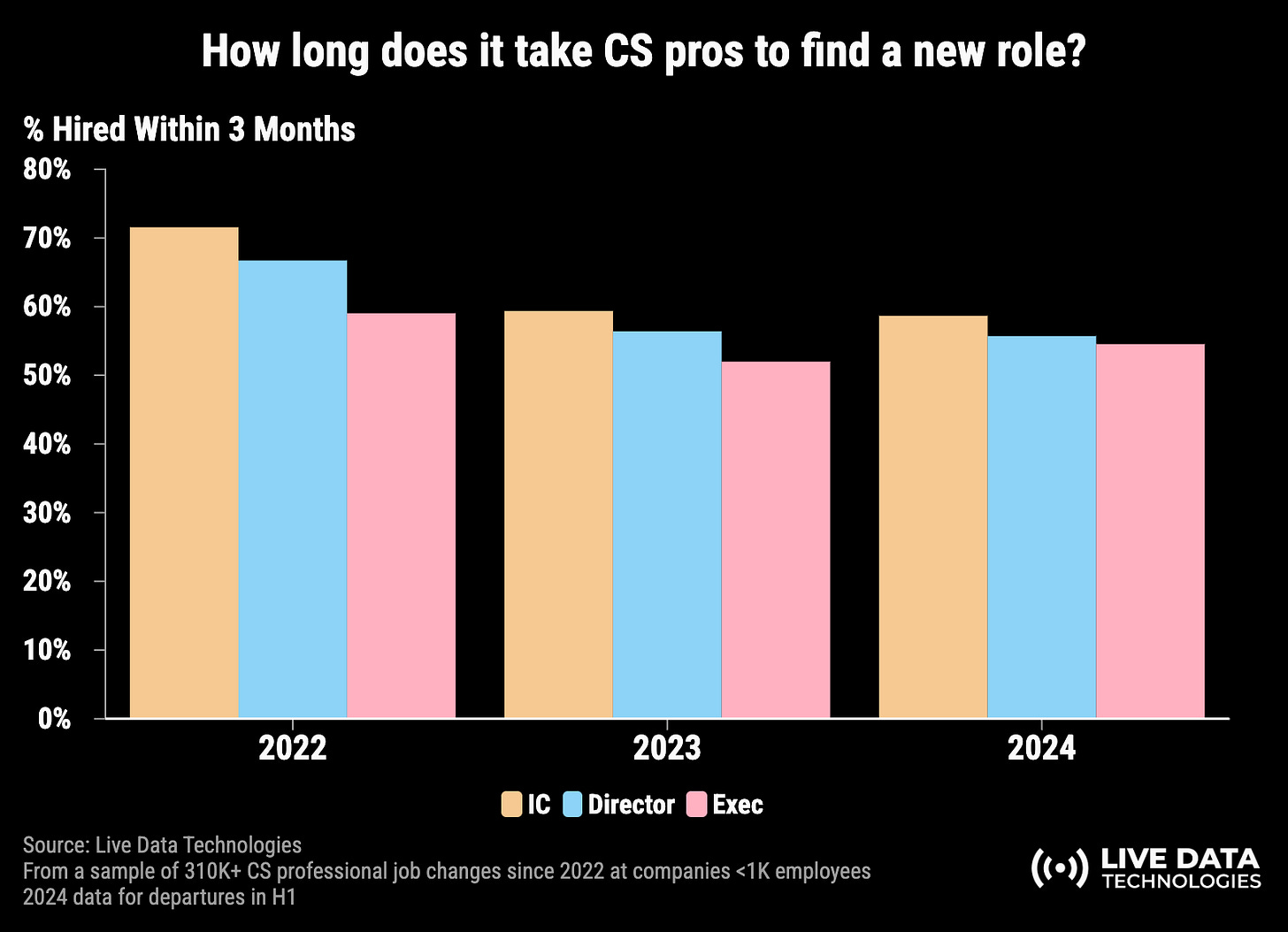

Longer searches for CS professionals

The job search process in Customer Success is among the longest in the entire go-to-market stack. Why is this?

CEOs making these hires consistently highlight that specialization has become a key priority since 2021. In the past, Customer Success roles tended to be more generalized across all levels, from individual contributors to senior leaders. Today, however, specialization has taken center stage, reflecting a shift in the demands and expectations of the role.

The macro environment plays a factor, but it’s the specialized skills being increasingly required that makes CS roles a longer more deliberate process.

There is also a huge amount of ambiguity and conflation around CS roles and what specialization even means. Is it…pre-sales? Post-sales? Onboarding? Retention? Engagement? Growth and expansion? Chasing down invoices?...

Scott Gifis (CEO of NoFraud) advises: “This challenge becomes even more pronounced as companies cater to different customer segments or profiles with varying needs. For example, an enterprise CS program requires a dedicated approach, but determining the right strategy for each account often involves complexities that are difficult to standardize until you achieve significant scale. On the other hand, a scaled CS program comes with its own distinct goals, systems, and operational challenges.

The complexity grows further as companies consider their mix of products and potential services, adding another layer of nuance to customer success strategies.

The key takeaway: start with a crystal-clear definition of the function's scope and avoid introducing unnecessary complexity too early in your journey. Additionally, ensure that your products and CX motions are designed to collect and act on data and signals effectively, enabling you to track impact and make informed decisions.”

Specializations and reporting structure shifts

The bifurcation+ of the CS role

One evolving trend in go-to-market is the bifurcation of Customer Success roles. Generally, there are two distinct paths:

The Revenue Model: Focused on expansion and renewals, this model is common for less technical, straightforward solutions that are easier to onboard. When CS operates under a revenue leader, there’s a natural accountability to ensure customers succeed while fostering an understanding of winning the right customers with the right expectations. These teams typically carry revenue targets and must demonstrate measurable impacts on expansion and retention rates, especially in product-led growth (PLG) models.

The Technical Model: Centered on support or professional services, this model often monetizes certain functions, particularly for highly technical or complex products. Under product leadership, CS gains a deeper understanding of customers and can focus on reinforcing value through the product experience itself. For labor-intensive, highly technical products, the connection to revenue may be less direct. Here, the focus is often on building deep, trust-based relationships rather than immediate revenue generation. In some cases, these teams shift toward monetized support and value-added service models, reflecting an increasingly common approach. This may be more product-centric, focusing on customer experience and customer journey. In this case, the advantage is a deeper understanding of the customers and how to ensure value is clearly reinforced through the product experience.

The divergence in CS roles, moving either toward highly technical or highly revenue-oriented focuses allows for clear ownership of KPIs.

While they both come with their advantages, they also come with their challenges. For example, in a revenue model, a CS leader may be tasked with transforming a team from high-touch, white-glove support to a consultative approach emphasizing value realization and expansion. For this transition to succeed, the leader needs deep domain and industry expertise to effectively coach and guide the team in value discovery. Leaders without this background often struggle to make meaningful changes quickly.

In areas like security, infrastructure, and other highly technical products, CS roles increasingly require technical depth. Positions that might have been branded simply as Customer Success through 2021 now carry a broader range of titles.

Who should customer success report to?

There’s always nuance in organizational structures, influenced by factors like leadership dynamics, individual leadership skills, and go-to-market strategies.

That said, the prevailing consensus is that CS should report to the CRO if one exists. The reasoning is straightforward: the CRO owns revenue. Splitting responsibility across multiple leaders often results in fragmented ownership, where no one has clear accountability for the entire revenue flow.

It’s like designing a menu. Just as an executive chef oversees the entire meal to ensure all the dishes complement each other, a single leader must own the full customer lifecycle to maintain alignment and cohesion. Without this unified approach, the “menu” could fall apart, leaving the organization disjointed.

That said, there is always nuance. For example, Lattice, an HR tech company, made a significant structural shift about two years ago. They moved their commercial customer success team under marketing, separating it from the rest of the CS function and placing it under the Chief Marketing Officer (CMO). This change was driven by a predominantly digital-led motion, with Customer Success Managers (CSMs) playing a supporting role.

Another emerging trend is presales teams taking ownership of customer success. By having Sales Engineers (SEs) own both pre- and post-sale processes, and aligning their compensation and incentives accordingly, you address a long-standing challenge: the disconnect between a high-touch, high-value sales cycle and the subsequent handoff to implementation. When SEs remain responsible for ensuring the solution delivers on its promise and overseeing renewals, there’s no ball to drop. This continuity not only strengthens trust with customers but also ensures the program consistently delivers the value that was sold. Having continuity between sales and customer success isn’t new, Kustomer went from $0 ARR to a $1.2B acquisition with both rolling up to one leader. In this shift, SE and CSM titles often get replaced with Customer Engineers.

While Customer Success organizations can look differently from company-to-company, one thing remains constant: The catch-all CS role previously filled by a non-technical, non-revenue-focused individual no longer exists. That was a “ZIRP-era” phenomenon that has since disappeared.

The challenges around finding the right role for CS leaders

Role ambiguity that can lead to broken models

Many CEOs and CROs struggle to clearly define what a Customer Success team should do. This lack of clarity around the role's scope and priorities often leads to extended hiring timelines and misaligned expectations.

As such, Customer Success organization often wind up operating as a remedial team that fixes problems that originate in other departments. Because of this, it can be difficult to tell whether your CS org in particular is causing problems with your revenue. Abbas Haider Ali and others detailed three clear CS failure modes in this deep dive on how to identify if your Customer Success organization is broken and how to fix it.

Though the root causes of each of these issues warrant their own posts, suffice it to say: if your CS team is operating in one of the below modes, they’re focused on the wrong problem set.

A CS team filling in for an AE team. Your CSMs own renewals and expansion. This can incentivize your AE team to oversell, which then puts your CSMs in the position of re-selling poorly-sized deals. If your CSMs were great sellers, they’d be AEs.

A CS team filling in for a support team. Your CSMs handle ticket escalations, provide long-running context for biggest customers, run incident communications, and chase root cause analyses (RCAs). If your CSMs were great support engineers, they’d be premium support engineers.

A CS team filling in for a services team. Your CSMs create project plans and scope services. If your CSMs were great at delivering professional services, they’d be solutions architects.

The specialized nature of the role

The title “Customer Success” no longer captures the full scope of the role. It’s one of the most specialized positions in the go-to-market stack, which explains why job searches for customer success leaders tend to be among the longest and most deliberate.

In customer success, domain expertise is paramount.

In a revenue-driven model, if a customer success leader is tasked with transforming a team from high-touch, white-glove support to consultative roles focused on value realization and expansion, they must possess a deep understanding of the domain and industry. This expertise is critical for effectively coaching and guiding the team through value discovery. Leaders lacking this foundational knowledge will likely struggle to make this transition quickly or effectively.

On the highly technical side of the bifurcation, the senior leaders likely need to help sell the value of the technical skill sets the CS Onboarding team brings to the table. Again, to do this industry and domain expertise is valuable.

Very few companies are at the ideal point in their maturity curve where CS is straightforward. The sweet spot is finding a company positioned on the steepest part of its breakout curve, where growth and impact align.

However, the customer success landscape is increasingly challenging, with intense consolidation and heightened competition. Compounding the issue, many CEOs still don’t fully understand the value of customer success or how to integrate it effectively into their strategies. Additionally, measuring impact in the world of CS remains notoriously difficult, making it harder to demonstrate its true value.

For a CS leader, joining a company without clear product-market fit (PMF) or evolving motions through growth stages can add even more complexity. For instance, a company might transition from an enterprise-focused model to a PLG approach to better align with market demands. In such cases, the CS strategies that worked under the first leader may no longer be a good fit, requiring a complete re-evaluation and adaptation of the CS function.

Customer Success roles open now

Below are some open roles, with GTMfund portfolio companies bolded.

Entry

Customer Success Specialist at Closer.io (Scottsdale, AZ)

Customer Success & Onboarding Specialist at Tobi (Remote - US)

Customer Success at SevenRooms (Remote - US)

Customer Success Specialist at Snapsheet (Remote - US)

Customer Success Specialist at Togetherwork (Remote - US)

Manager

Enterprise Customer Success Manager at Writer (Hybrid)

Customer Success Manager at Spekit (Hybrid - Denver, CO)

Enterprise Customer Success Manager (PST) at WorkRamp (Remote - US)

Manager, Enterprise Customer Success at CaptivateIQ (Remote - North America)

Customer Success Account Manager at Microsoft (Remote - US)

Customer Success Operations Manager at Culture Amp (Hybrid - San Francisco)

Sr. Manager, Customer Success at DataKind (Remote - US)

Customer Success Manager at Motion (Remote - North America)

Customer Success Manager at ServiceTitan (Remote - US)

Customer Success Manager at DearDoc (Hybrid - New York)

Customer Success Manager at Sphera (Remote - US)

Director

Customer Success Director (Individual Contributor) at OfferFit (Remote - LATAM)

Director, Customer Success at Lucet (Remote - US)

Director, Customer Success at Swooped (Remote - US)

Director, Customer Success at Bravado (Remote - US)

Head of Customer Success at Copy.ai (Remote - US)

Director, Customer Success at Pursuit (Remote - US)

Director, Customer Success at lulafit (Remote - US)

Sr. Director, Customer Success at Critical Start (Remote - US)

Customer Success Director - Technology at First Advantage (Remote - US)

Director, Customer Success at Corpay (Hybrid - Brentwood, TN)

Head of Customer Success, Enterprise at Fundraise Up (New York)

VP/C-level

VP, Customer Success at NextRoll (Remote - US)

VP of Sales and Customer Successat Oceans (Remote - US)

VP, Customer Success at Artisan (San Francisco)

VP, Customer Success, Americas at Braze (New York)

VP, Customer Success at Veza (San Francisco)

VP, Strategic Customer Success at EliseAI (New York)

Head of B2B Customer Success at Pathstream (Remote - US)

VP, Customer Success at Everlaw (Hybrid - Oakland, CA)

Tag GTMnow so we can see your takeaways and help amplify them.

👂 More for your eardrums

The GTM Podcast - subscribe on Apple, Spotify, YouTube or wherever you listen.

Mark Kosoglow is the Co-Founder and CEO of Operator.ai, a company incubated by GTMfund. Mark was employee #1 at Outreach and former SVP of Global Sales, where he helped grow the company from zero to over $200 million in revenue.

👀 More for your eyeballs

The old playbook of "pipeline solves all problems" is broken. The highest-performing sales teams are taking a different approach and getting 2–3x more revenue from their existing opportunities, turning funnel efficiency into their biggest competitive advantage. Join revenue leaders on December 12th for an in-depth conversation on how to convert opportunities into revenue.

Learn how to win in the margins. In a brand new video series, TestBox's James Kaikis interviews eight B2B SaaS leaders who are rewriting the traditional GTM playbook. Learn how leaders from companies like People.ai, Owner.com, G2 and more are capitalizing on incremental innovations and non-obvious advantages to drive outsized results in GTM. Catch the full series, The New GTM Playbook, here.

Successful customers are the foundation great businesses are built on. As AI enables us to build software at an unprecedented pace, the truest competitive moat is knowing your customers. Read why customer success matters most in a vertical AI world.

🚀 Startup to watch

Spekit - launched AI Assist, an AI-powered solution for sales reps that empowers teams with the knowledge they need, when and where they need it. The intelligent assistant answers questions, recommends content, and guides users within any app, boosting productivity and knowledge sharing.

🔥 Hottest GTM jobs of the week

Enterprise Account Executive at Patch (San Francisco)

Market Development Representative at Patch (San Francisco)

Senior Product Manager, TAP at Vanta (Remote - US)

Growth Marketing Manager at Gorgias (Toronto)

Account Executive at Pocus (San Francisco)

See more top GTM jobs on the GTMfund Job Board.

🗓️ GTM industry events

Upcoming go-to-market events you won’t want to miss:

Spryng by Wynter: March 24-26, 2025 (Austin, TX)

Pavilion CMO Summit: April 17, 2025 (Atlanta, GA)

SaaStr Annual: May 13-15 (San Francisco, CA)

Pavilion CRO Summit: June 3, 2025 (Denver, CO)

Pavilion GTM Summit: October 14-16, 2025 (Austin, TX)