This week the team flew down to San Mateo for SaaStr - tons of great networking and sessions.

A quick shoutout to two incredible GTMfund portfolio company founders who shared the same stage: Melanie Fellay CEO and CoFounder of Spekit, and Christina Ross CEO and CoFounder of Cube, who ran a session at SaaStr on The Top Founder Mistakes to Avoid on The Path to $10M in ARR 🚀 alongside Shiloh Johnson, Founder/CEO of ComplYant.

We’re officially running a GTMfund Summer Giveaway: Share your favourite piece of our content (Newsletter or Podcast) on either LinkedIn / Twitter, tag us, and you’ll be entered to win a pair of exclusive GTMfund Airpod Pro’s.

Where SaaS is and Where SaaS Will Be in 2024

This newsletter draws inspiration from one of our favorite talks at SaaStr from David Sacks’s (GP of Craft Ventures) with Jason Lemkin on Where SaaS is and Where SaaS will be in 2024.

Here are the 5 biggest takeaways from the session:

Falling Seed to Series A Graduation Rates

During the boon 2020 and 2021, the graduation rates from Seed to Series A sat well-above historical averages. Investors took advantage of that arbitrage and looked pretty smart. Why not invest at Seed when so many of your portfolio companies will get marked up at Series A?

The problem? Series A graduation rates are dropping. There’s some dispute on the exact numbers, but David expects the graduation rate which peaked near 80% to drop all the way to ~20%. Regardless of the exact numbers, the conclusion remains the same: Series A investors have raised the bar and that jump doesn’t look as straight foward as it did before.

High vs Low Margin SaaS Models

Software is an inherently high-margin business. Most of the cost of building the product (R&D) is completed in the early-stages of a company’s lifecycle. As you grow and the product evolves, the incremental cost of distributing that product - or creating one more software instance - is next to zero. That’s where 85%, 90%+ gross margins come from. That’s the appeal of SaaS.

That’s not every software company though. There are many software companies that exist will the need for real world, infrastructure. These are much harder to execute, but include some great companies of the last decade, including Instacart, who just filed their S-1! The challenge is correctly calculating your margins. They should improve as you scale, but if you’re calculating them incorrectly - which is easy to do - you can go out to raise from astute, late-stage investors and find out your margins are 10-15% lower and it’s too late to turn the ship around.

Building a company during a downturn is the best time to do so

For Sacks, Pay Pal was predominantly built in the wake of the dot-com bubble. Yammer was built in the wake of the great financial crisis. It’s not easy to build a great company. It’s not easy to build a great company in a difficult economic environment. But if you can execute, there are some compelling tailwinds to take advantage of: available talent, less competition, and a rigid focus on sound business fundamentals.

In 2021, if you had a good idea and raised funds, you’d blink and 5 competitors would appear from thin air. That’s not the case today. Some of your competitors will falter, some will never get off the ground. It’s a hard environment, but that’s the thing about building companies - it’s always hard. There’s more opportunity than ever today.

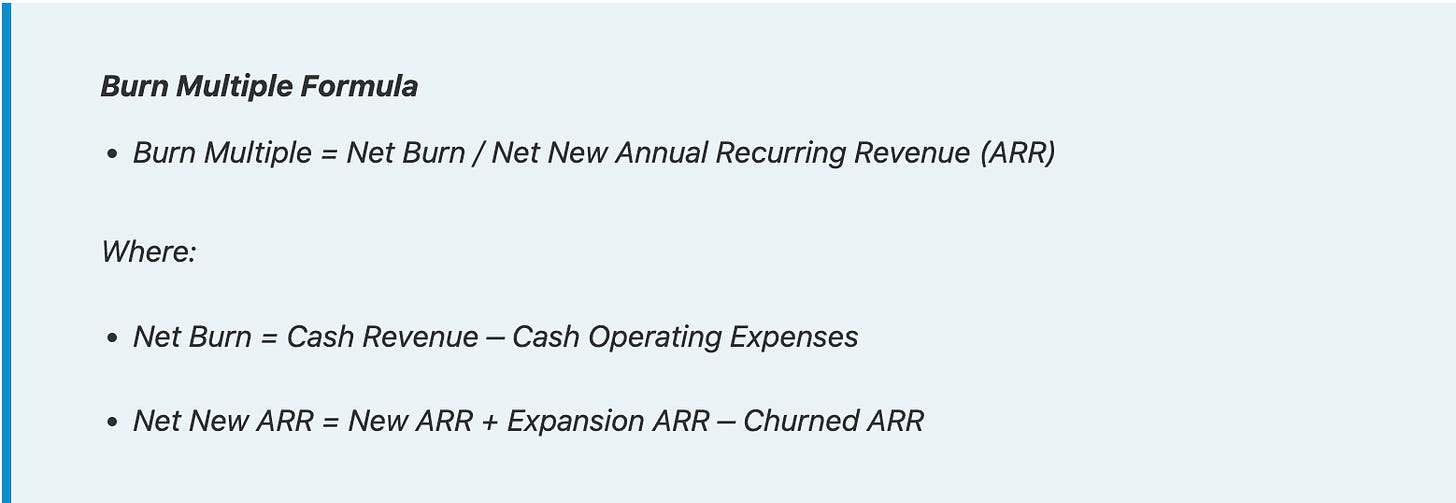

CAC vs burn multiple

Sacks wrote a blog on this specific topic back in 2020 (note: a lot has changed since then but this one still holds up) see here.

The Opportunities in AI

Not to our surprise, AI was at the forefront of just about every conversation at SaaStr. Looks like no one can get away from it.

David Sacks mentioned that 70% of Crafts investments are allocated toward AI and divided their AI opportunities into 3 buckets:

Infrastructure

CoPilots

Pre AI SaaS Apps

Let’s unpack each of these buckets, in order to better understand the trajectory of AI startups; which are higher risk vs lower risk investments.

Infrastructure

We’re currently seeing a lot of these AI infrastructure tools raising capital at extremely high valuations - Sacks predicted that infrastructures are ultimately going to be owned by big tech companies, and they’ll be a lot of M&A activity in this space.

Some examples of companies that serve as infrastructure-like AI tools are: Weaviate, Gantry, Writer.com, OpenAI.

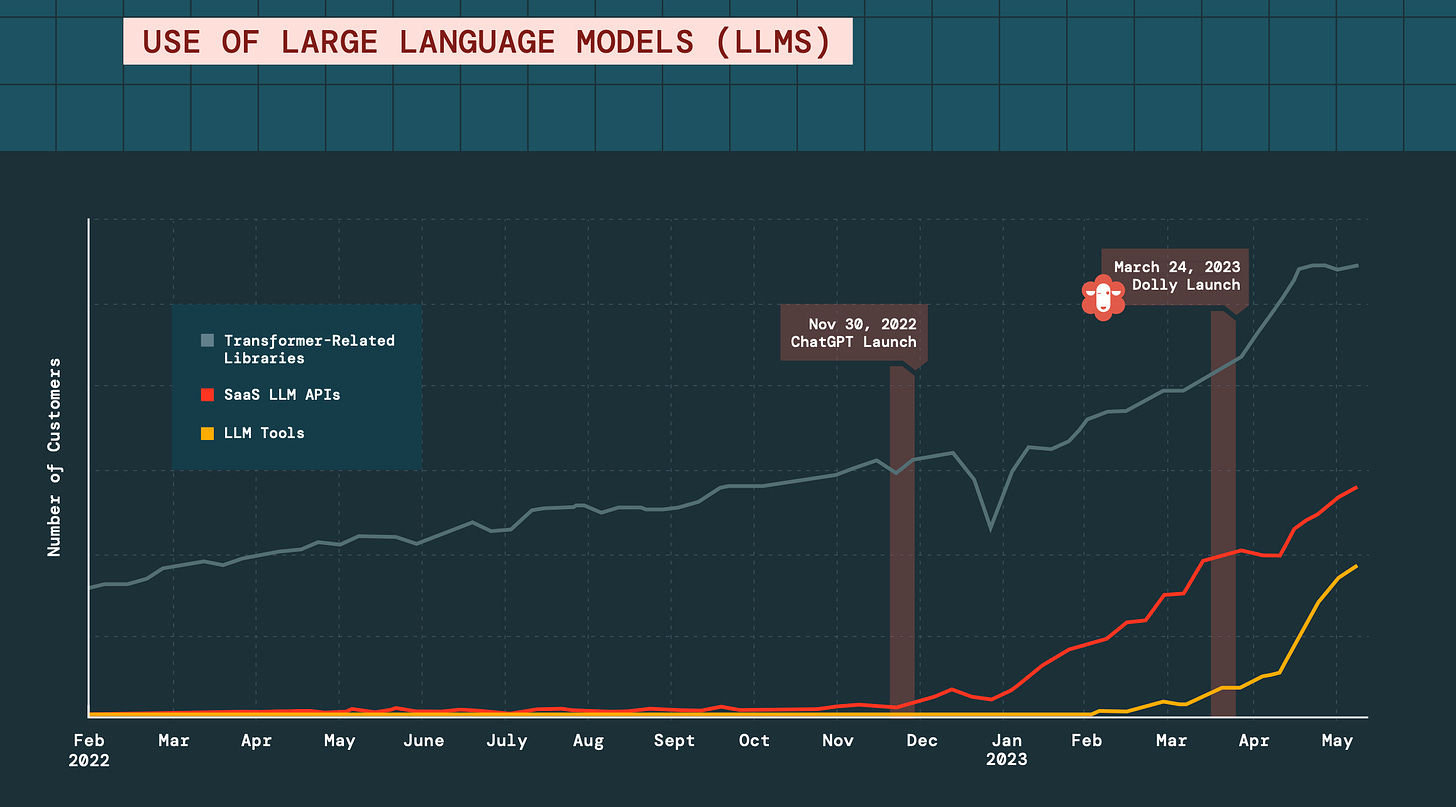

These tools include Large Language Models (LLMs) and DS / ML applications - LLMs are currently one of the hottest and most-watched areas in the field of Natural Language Processing (NLPs). LLMs have been instrumental in enabling machines to understand, interpret and generate human language in a way that was previously impossible, powering everything from machine translation to content creation to virtual assistants and chatbots.

Databricks launched a report on the state of Data & AI in May of 2023, stating that the fastest-growing data and AI products are Data Built Tools (DBT), a category which grew 206% YoY by number of customers.

Across all industries, companies leverage data science and machine learning (DS/ML) to accelerate growth, improve predictability and enhance customer experiences. See photo below that Databricks released on the growth trajectory of LLMs over the last year.

CoPilots

Sacks predicts that there will be CoPilots for most job functions, if not already ie. Lawyers, Doctors, Salespeople & Marketers.

Companies that serve as CoPilots include: R2D2, Lindy, Groundswell

During a session on Generative AI and the Inversion of SaaS, ran by the VP of Generative Builders at Amazon Web Services, Adam Selignman mentioned that assistant agents are being built across SaaS orgs to function as CoPilots for all Go-To-Market functions, as well as developer tools. A very widely used CoPilot is GitHubs CoPilot tool, significantly enhancing the coder experience.

Pre AI SaaS Apps (with AI layers)

These SaaS apps have proven to be turbocharged in their value by adding AI functionality. These tools wont be deep foundational models, but rather leverage AI to enhance their tools. Widely used tools like Gong, that recently came out with a proprietary technology purpose-built for revenue teams and can be tailored to your business. Ramping productivity through automation and guidance, improving business decisions, and ensuring that initiatives succeed.

Other SaaS Apps with AI Layers include: Lang.ai, Stotles, Sapient.

Stotles recently launched their AI outreach tool which creates AI tailored emails within seconds 👀

👀 More for your eyeballs:

👂 More for your eardrums:

We can’t get enough of Mel Fellay this week! Podcast is out with the CEO and CoFounder of Spekit, she shares all the truths behind building a startup during a recession downturn.

🚀 Start-ups to watch:

AudiencePlus featured in Forbes this week, AudiencePlus is betting big that “owned media” is the future of marketing...and we tend to agree.

🔥Hottest GTM job of the week:

Head of Customer Success at Regrello, more details here.

See more top GTM jobs here.

Signing off from Napa for our annual GTM retreat with +100 of our Limited Partners.

Hope y’all have a great weekend & for those who were at SaaStr, share your biggest learnings / takeaways with us!

We’d love to hear them.

Barker ✌️