GTMfund Yearly Recap + Top GTM/VC Resources for 2023

The GTM Newsletter

Thanks for letting us hang in your inbox this year.

This newsletter has been read over 20K+ times since we re-launched in late Oct.

I hope you all had time to recoup, relax and reflect on a wild 2022 over the holidays.

A quick heads up: this edition of The GTM Newsletter will be formatted a little bit differently.

Since you’ve been an early subscriber and part of the broader GTM community, we wanted to give you a little behind-the-scenes look at GTMfund and some of the insane growth/learnings we’ve had over this two year journey.

We’re also going to share some of our personal favorite resources for everything “Go-To-Market” and “Venture Capital”.

The places we go when we have “un-googleable” questions.

Alright, let’s get into it.

The GTMfund Yearly Recap

We just sent out our last LP update of the 2022 GTMfund. None of us can believe it’s already been 2 years since we started the fund.

We’ve learned A LOT.

We’ve grown A LOT.

And the best part: we’re having A LOT of fun.

Here’s an excerpt from our last LP update of the year recapping an amazing 2022.

–

LPs - there’s a lot to dig into here, but we’re going to keep it shorter than normal. This is the final update of 2022 and a big year for GTMfund.

We’ll save space for a highlights section below.

In December, we hosted a Holiday Happy Hour with our friends from F-Prime in SF! Great group of operators, founders, and VCs.

Excited to host even more events next year.

Big thank you to Tom Boccard for hosting a session on Enterprise Sales for our Portfolio Companies. We received a ton of great feedback.

We’re taking a very intentional approach to our GTMsessions beginning in 2023. It’s going to look more like a curated GTM accelerator curriculum - brought to you by the best GTM operators in tech!

We also ran a session with the Capchase team on their new product launch: Capchase Pay. We’ve been partners with Capchase for over a year now. They’ve been one of our most successful portfolio companies, and we love seeing their continued innovation.

Deal Highlights from 2022

We wanted to highlight 5 companies we invested in this year. Of course, we’re excited by far more than 5 companies from 2022. But we think these are indicative of (1) the GTMfund value proposition and (2) where we want to continue to play in 2023 and beyond.

Channel99 - Seed (first capital)

Chris Golec is the type of entrepreneur we want to get behind. He sold his first company, Supplybase, for $380M back in 2000. He went on to build an entire category at Demandbase for his second act (and $200m+ ARR). Channel99 is his third venture. This is as proven as it gets for a B2B SaaS entrepreneur.

The funding round consisted of us, Chris’ own capital, and his 3 closest venture partners from previous companies. We got in at the earliest stages and we got in because of the value proposition this network offers founders - even the most experienced ones.

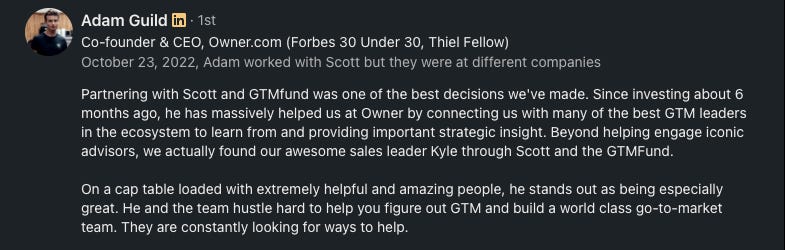

2. Owner.com - Series A

We arrived late to this one. The Series A was already closed. The list of investors included household names and exceptional operators: Redpoint, SaaStr Fund, Altman Capital. We convinced Adam (Co-Founder/CEO/Thiel Fellow) to go to the board, reopen the round for us, and get us in at the same valuation the other Series A investors participated. Adam challenged us from Day 1. If he was going through all of this work to let us in, we better deliver value. He needed GTM support. The gauntlet was thrown down.

Fast forward 9 months: our very own LP Kyle Norton joins as the SVP of Sales, we’ve provided hours of advice, consultation, and a steady pipeline of GTM talent. We get shoutouts on almost every investor update. We receive notes like the one below.

The value proposition gets us into even the most competitive deals. And then we deliver.

3. Roam - Series A

Howard Lerman is the Co-Founder and former CEO at Yext. He didn’t need our capital. To date, he had put his own money to work and only allowed in a select few trusted partners from his days at Yext. The cap table was short.

This deal highlights a few important pillars for us: (1) working with proven entrepreneurs (2) the appeal of GTMfund to even the most seasoned founders and (3) big visions. Howard is building the next generation Cloud HQ. The office of the future. Proven founders with huge visions is exactly where we want to be playing. (He posted the following on our LinkedIn post, unsolicited)

4. Infra

We got introduced to Infra from one of our other founders - Sean at Magic. The Infra team were his Co-Founders from their last startup, Kitematic, a company they sold to Docker. Sean vouched for us as investors. And again, we’re talking about experienced entrepreneurs.

We ended up securing an allocation in a competitive deal, led by the same top-tier firm from their previous round. When we provided Michael and Jeff (Founders) a lot of value in the early days of our relationship, the partner from their lead VC wanted to meet. He’s since sent us several more exceptional deals, including one that we closed recently, and become a strong relationship for us.

As a vision, we’re very excited by what the Infra team is building. They’ve been executing at a high-level since we partnered.

5. Regrello - Series A plus double the stock

I heard Aman was working on a new company through our contacts at a16z, who funded his Seed round. I was an advisor in Aman’s last company that was acquired. He had a lot of Tier 1 VC options for his round, but wanted a specific investor. He also requested an intro to a specific advisor. We made both introductions for him and both converted. We were not only given access to the round, but were able to get roughly 2x the amount of shares by having the 2nd half be advisory (common) and doing it as immediate vest and exercise.

We provided so much value even before we wrote a check, that we were able to get favorable terms for the fund. Our network and cache is already so insanely valuable.

GTMfund Highlights

Launched the Media Pillar (Podcast + Newsletter)

We’ve seen the power that distribution brings first hand from our days building Sales Hacker (and how that was leveraged by Outreach to turn the competitive tide).

A “distribution advantage” acts as a force-multiplier in everything you do. And we believe that advantage multiples again when you have a specific knowledge set like we do (hyper-specific GTM knowledge from real operators) that our competitors (other firms) don’t have.

That’s why we made a calculated bet this year to invest time/resources into building up a media engine to bolt on top of the fund.

This bet is already paying off in the form of: more deal flow, second-time founders seeking us out, better brand recognition, helping our founders build up their own brands/thought-leadership, driving demand to Port Cos, helping source candidates for Port Cos, helping us win bigger allocations, etc.

By the numbers:

The GTM social footprint: 6400+ followers across LI, Twitter, TikTok

Since launching The GTM podcast just 2.5 months ago: we’ve already had 8202 downloads (likely to cross 10K by EOY).

During the same time frame, we’ve had 2598 GTM leaders subscribe to The GTM Newsletter and it’s been read over 20,727 times since launch.

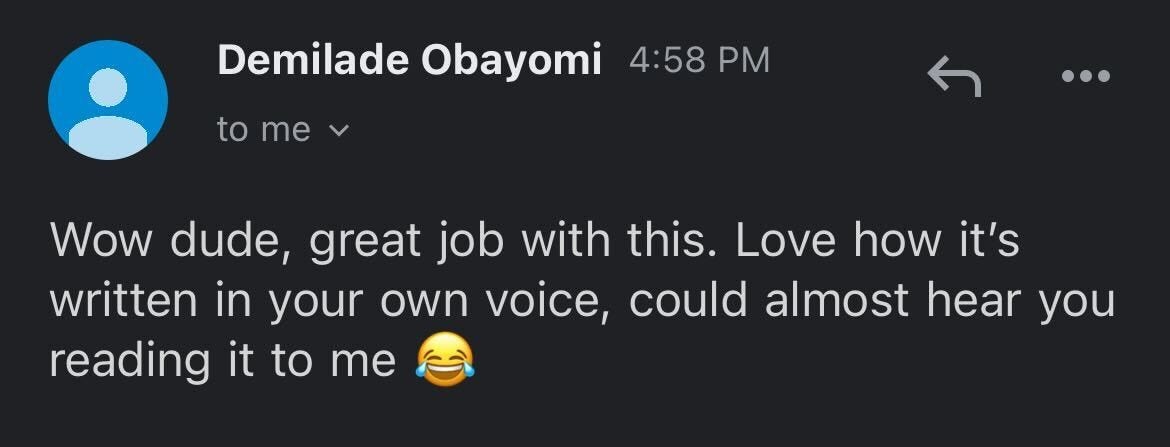

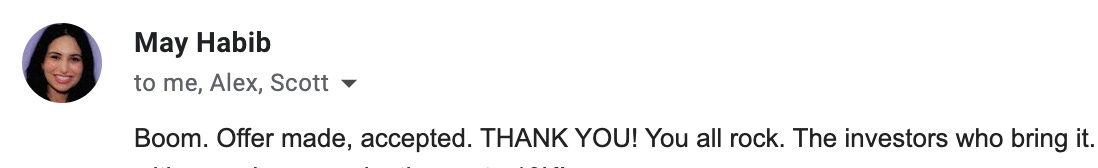

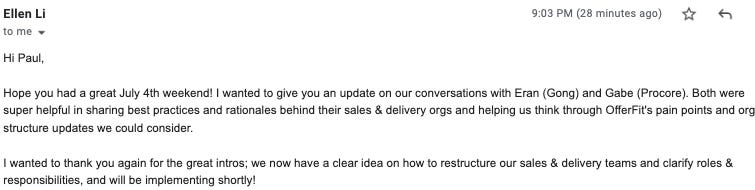

We’re lucky to get notes like the ones below every day and these are only made possible by incredible LPs (like you!) who showcase your knowledge/wisdom/battle scars for others to learn from in the pod/newsletter each week:

A big thank you again for all those who have contributed ideas/thoughts/strategies. We plan to scale these channels out in a big way next year and we’ll continue to highlight our LPs which, in turn, we hope gives a positive halo effect in your personal career trajectory/journey.

You gotta love win-win-win flywheels once they start cranking!

2. First GTM Retreat & Other Events

We hosted our inaugural GTM Retreat in Scottsdale! 80+ GTM Leaders, hiking, golf, dinners, and a lot of great memories. We’re looking forward to making these Retreats a staple of the GTM experience.

Due to Covid, we didn’t host any in-person events in 2021. As wonderful as the Slack community can be, virtual spaces are never a replacement for experiencing a community in-person. In addition to the Retreat, we hosted dinner events in: San Francisco (x2), New York, Austin, and London.

3. Growth by the Numbers

The holidays and EOY provide space for reflection. You have time to look back on the year and really dissect what went well, how you’re improving, and how far you’ve come in that span of time. Re-reading our 2021 recap, it’s hard not to get reflective. This fund - and by proxy this community - has grown a lot in 2022.

So let’s put some numbers to that growth:

110 new GTM Leader LPs / Members

Growth in Capital: $5.9M → $15.1M → $50M

LP intros to portfolio companies: 250+

Portfolio company fundraising intros to VCs: 155+

Portfolio company intros to candidates: 475+

Total Network Intros for our Founders: 1,000+

Number of LPs who joined Port Cos as Operators: 8 :)

The best part? We’re just getting started. All of our programs and the infrastructure surrounding the fund continues to grow and improve. This is just the beginning.

4. Founder Feedback

Just as we are nothing without this community of GTM leaders, we are also nothing without the success of our founders. Both are intimately connected. We’ll end the highlights where it matters most: love from our founders.

Want to learn more about our 2023 plans or find a way to get involved?

Shoot me a message directly through here or on LinkedIn.

👀 More for your eyeballs (Top GTM/VC newsletters/blogs for 2023):

👂More for your eardrums (Top GTM/VC podcasts for 2023):

👨👩👧👦 More for your neural networks (Top GTM/VC communities to join in 2023)

🚀 Start-ups to watch:

With my man, Mark Kosoglow, now at the revenue helm at Catalyst. There’s no doubt that they are going to have a break out year in 2023. He also just recruited Alex Kremer to join him to help scale out the sales team. I got to work alongside this dynamic duo at Outreach and saw first hand their ability to build and inspire great teams. Keep your eyes on them.

🔥Hottest GTM job of the week:

Director of Customer Success at Catalyst, more details here.

See more top GTM jobs here.

—---------------------------------

I’m hoping this is the last thing you read before the New Year.

Close up that laptop.

Check out of your inbox.

Clear your head.

And go ring in 2023 with your friends and family.

See you in the new year 🥂

Big things ahead.

Barker.

✌️