Writing this from the Centurion lounge at SFO - If you’re anything like me, you’ve likely clocked some serious hours in here over the years.

Currently riding high on some frantic pre-flight productivity.

Thanks to Michael Downing and team for hosting GTMfund at a fantastic event at The Stanford Research Institute yesterday bringing together emerging VC managers and the broader LP community.

Anyway, let’s get into it.

We’re officially running a GTMfund Summer Giveaway: Share your favourite piece of our content (Newsletter or Podcast), tag us, and you’ll be entered to win a pair of exclusive GTMfund Airpod Pro’s.

Alright so let’s kick this off with an intro to Jason Vargas.

The first 13 years of Jason's career were focused on building and scaling companies from pre-seed through series D. Jason was able to take a company from zero to 10 million ARR with no VC funding. Now, as co-founder of RevShoppe, he’s focused on designing GTM strategies, creating those strategies as workflows and levering them into a system of action.

RevShoppe has helped teams like DocuSign, Adobe, Pinterest, Patient, Pop, many, many more fantastic sales teams build and scale their outbound programs.

Below is from a GTMsession that we ran this week for our founders.

Strategy & Design

Jason Vargas:

We're going to be talking all about outbound. But as you begin to think about your Go To Market motions and types, there are always different things to consider. So with outbound, there is the cold outbound. But in today's world, with the amount of access to data, you don't need to be 100% cold. I think a lot of people think they do, and you really don't. I think that should be the last resort. When it comes to outbounding, you want to look at more of a warm outbound, which is the informed outbound where you're leveraging Intent data tools like Bombora or Six Sense. Or if you have Zoominfo, they also have an Intent piece, there's just so much access to information to be able to get insights these days.

So let's dig in here.

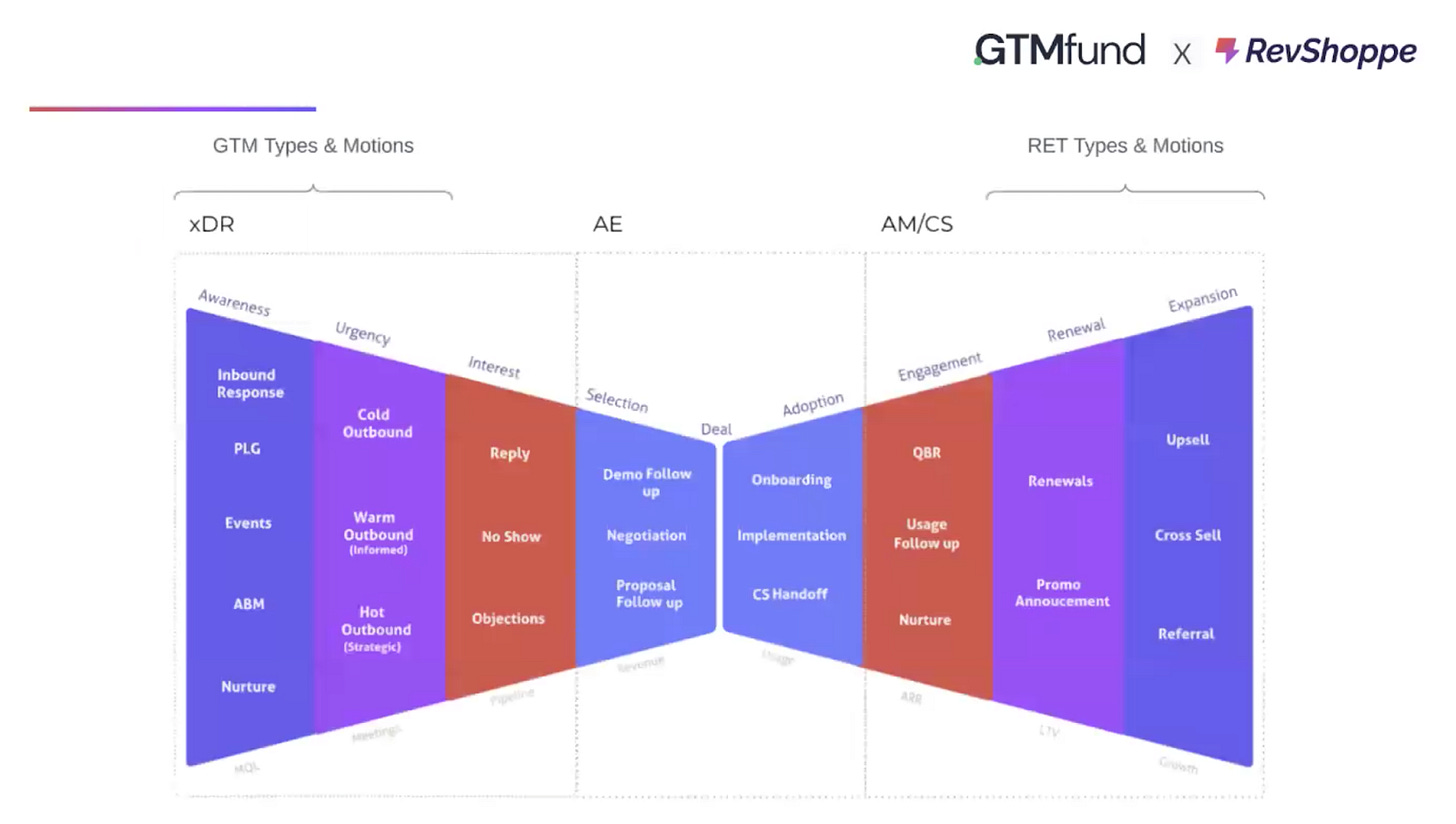

Go to market types

So there's types and then there's motions. Today the type we're talking about is outbound. And I see a lot of teams get this wrong, they don't think about the fact that there's an Enterprise motion, there's a mid market motion and there's SMB motion. The strategy should not be the same, the messaging should not be the same, the approach shouldn't be the same, you shouldn't have high touch like manual steps all the way through for a SMB or low target, a low level target.

You want to be able to make sure you break these up. For example, if you're focused on Enterprise, this is a type of motion where you can apply an ABM approach. This will be more of the high touch white glove process.

So when you think about building this motion, what's the segmentation? What do these accounts look like?

And then when you go through account selection, you want to make sure that you're selecting accounts that align to this. And we'll dig in a little bit more in terms of how you can segment this out. We have a process for how we do that and the play design.

So if you're doing an Enterprise outbound play, what do those touches look like? Are you doing any gift sending? Are you meeting them in person? Are you writing them hand-written notes? Are you calling them?

Whatever the case might be, this is where you want to put the thought process into. How are you actually going to reach out to these people? And then what's the messaging behind that? As you're crafting your messaging for emails, your call scripts or gift sending, what is that message? You want to make sure that it aligns to the specific play. It aligns to the account and the segmentation. So all these things that you're doing here are going to lead up to what is actually going to be said and when.

This is foundational because you want to make sure you're reaching out to the right person with the right appraoch. The play design, using a football analogy, you want to make sure you have all the play specific for a specific outcome. So what is that when it comes to enterprise motion?

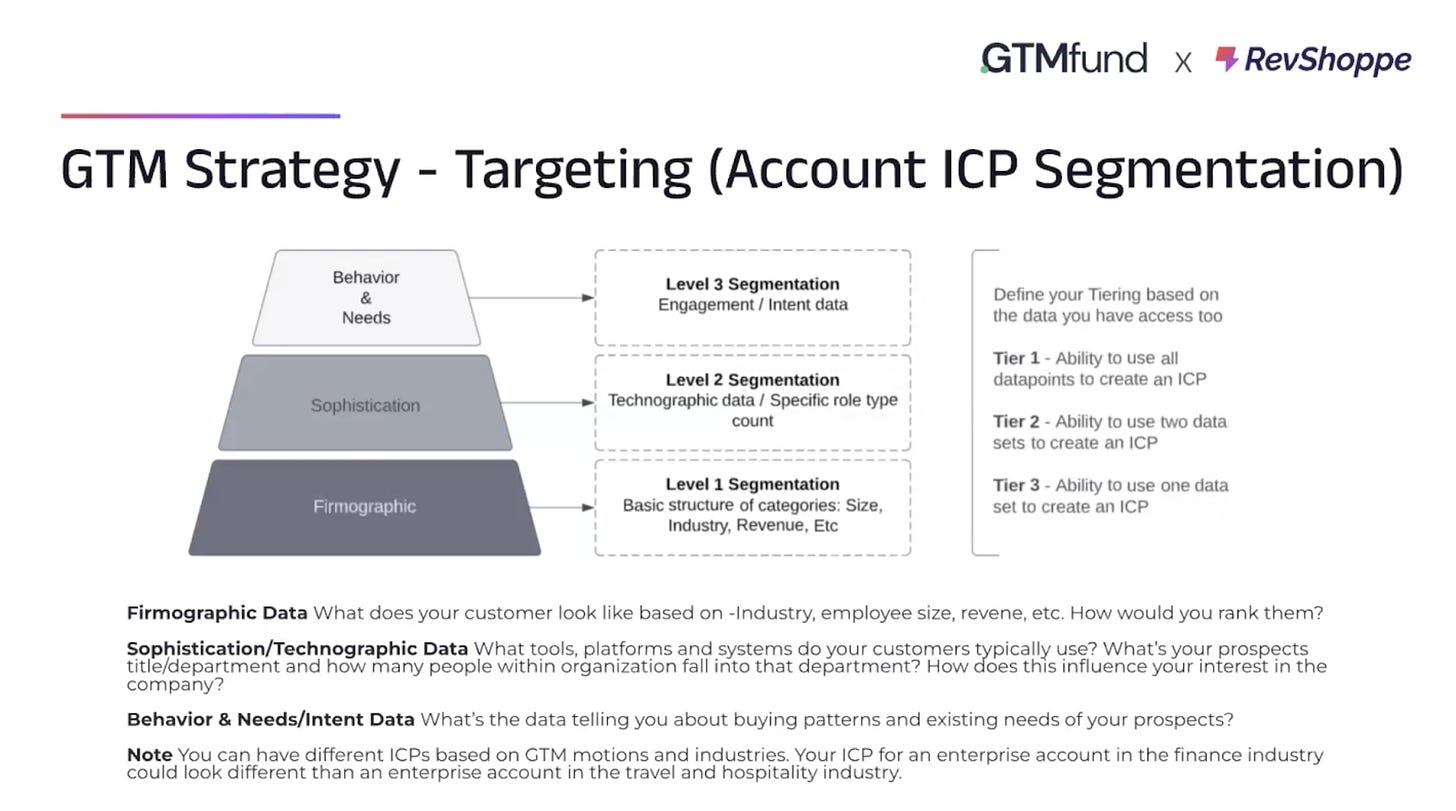

All right, so let's look at how we think about segmentation:

We're all very familiar with this: TAM , SAM.

But I want to take it like a different layer, just a different way to view this.

So you want to look at your prioritized pipeline.

The prioritized pipeline or your ‘already in market’ pipe with access to intent data, like Bombora, you have the ability to really find this.

So as you begin to understand your total addressable market. In an ideal world if we can tackle it all in one shot, amazing. But again, there's a lot of constraints of time and resources. So the next layer is your total relevant market, which a lot of us are familiar with doing, which is winding it down to what is your ICP?

So you get your ICP, then the next level is, can we identify which ones are actually in the market, ready to buy?

And depending on your segment, the answer oftentimes is yes, because again, we have access to a lot of data in 2023.

So the goal is to go aim for your total relevant market and then over time, total addressable market. But you should really focus on relevant first (the low hanging fruit).

What are the one or two, maybe even three plays that are really going to move the needle for you and then hyper focus on that and make sure all the resources, the team, everything is aligned to those plays and they're just driving those over and over again. And make sure that they're supported from an enablement standpoint.

The 3 Layers

So we have three layers, but one of them has two types of data. The baseline is your firmographic data. What does it look like from an industry size? Revenue. That should be your baseline. Everyone has access to that. So this is where you begin.

You’ll have your mid market, Enterprise and Strategic, etc. Identify what that is for you in your business. The next level is what we call Sophistication data. So that can be your Technographic data.

Are you selling a product to marketing people? You’ll want to look at how sophisticated your buyer is? Are they using something like a HubSpot? Are they using something like a marketo?

Those are different.

Marketo users would be more sophisticated as it’s much more expensive.

And then you can begin to look at what all the marketing technologies that they're using so you understand what their spend is. And then you can also look at their specific role type. So if a team has two marketing people versus 50 marketing people, and they're using five different marketing tools that are on the expensive side, then you understand that they're very sophisticated and they have high level spend when it comes to marketing.

How do you know if you are still focusing on the right accounts with the right assumptions? Is it an iterative process?

Jason Vargas:

Yeah, I think that's great and I think it does change over time as you begin to scale as a business and you want to start moving upmarket, things like that. But yeah, it is an Iterative process. And so I think the measuring when you begin to reach out to these people, measuring the data, measuring the responses, measuring all of that is going to be very important to see.

Building these segmentations out for customers, What we're then looking at is as we're reaching out to folks, how many meetings or how many opportunities have been created. That's our main thing that we look at how many meetings or opportunities have been created and then we look at all the other metrics, like opens, replies, clicks, positive sentiment, things like that. But the first core metric is how many meetings were booked or how many opportunities were created.

You want to test that. So typically for us, we always say like at least 300 prospects, personas or contacts should have gone through this process. And to understand, is this actually working?

But at least prospect to see if our assumption is correct. Is the messaging that we've aligned to what we're seeing with the data, is this actually moving the needle? Are people responding? Are we getting activity?

Over a course of say, a month to two months. If we don't see any traction, then we adjust.

You will find that maybe your first assumption didn't work, but maybe your second will. But again, it is very much of an Iterative process.

So messaging, strategy and structure.

When you are designing your go-to-market strategy, you want to think of this from the messaging standpoint of who belongs in a low touch framework, mid touch and high touch.

Anything that will give a little more insight to the account. We would consider SMB more of a low touch. Do you have a lot of insight? Low insight? Then you can classify it as a low touch or mid touch account.

Now, how do you actually think about who goes where?

Well, we built this out for one of our customers. So when they're looking at companies, we looked at to see, do you have general data, do you have behavior, intent data? So do they have social data or account data?

If they have all four, well, then. It's easy for us to understand, they go into high touch framework.

If they have three, then they can go to Mid touch.

If they have one or two, then this goes into more of a low touch framework. So this is a way who you can actually think about how to execute this in action.

So as you're building your automation, whatever data you have access to can be a way to auto route specific counts or prospects into different frameworks.

That way it's supporting your team. So especially as you begin to scale, a lot of times reps don't know where a prospect should go, like what sequences or cadences should I be using, when do I want to use a low touch? A lot of this you can build some level of automation to be able to support these actions.

That way you can take a lot of the thinking from the rep, you want to make it as easy as possible for them. So all they're focusing on is communicating with the prospect versus like, “okay, crap, where does this actually go?” The above framework should help you apply this thinking.

(…to be continued next week)

👀 More for your eyeballs:

See how your company’s performance compares to that of your competitors in ARR Growth, Net Margin, Customer Acquisition Cost, Logo Churn and more.

👂 More for your eardrums:

This week we had the CEO and CoFounder of Keyplay & PeerSignal.org on the GTM Podcast, Adam Schoenfeld 👏

🚀 Start-ups to watch:

One of the GTMfund’s community members Eli Rubel has recently launched his design company 🎨 They do everything from brand identity, to websites, to marketing design work and have helped companies like Loom, Dropbox, and many others✨

If you’re in search of any design needs, check em out!🔥 NoBoringDesign👀

🔥Hottest GTM job of the week:

Account Executive at Owner.com, more details here.

See more top GTM jobs here.

Stay tuned for part two on Cracking the Outbound Code with Jason Vargas.

Part two will cover setting up strong cadences, sequence weaving, and the most effective messaging frameworks.

Enjoy the sunshine wherever you are☀️

Barker✌️